Business Owner’s Toolkit

Qualified Plan and Non-Qualified Plan Design

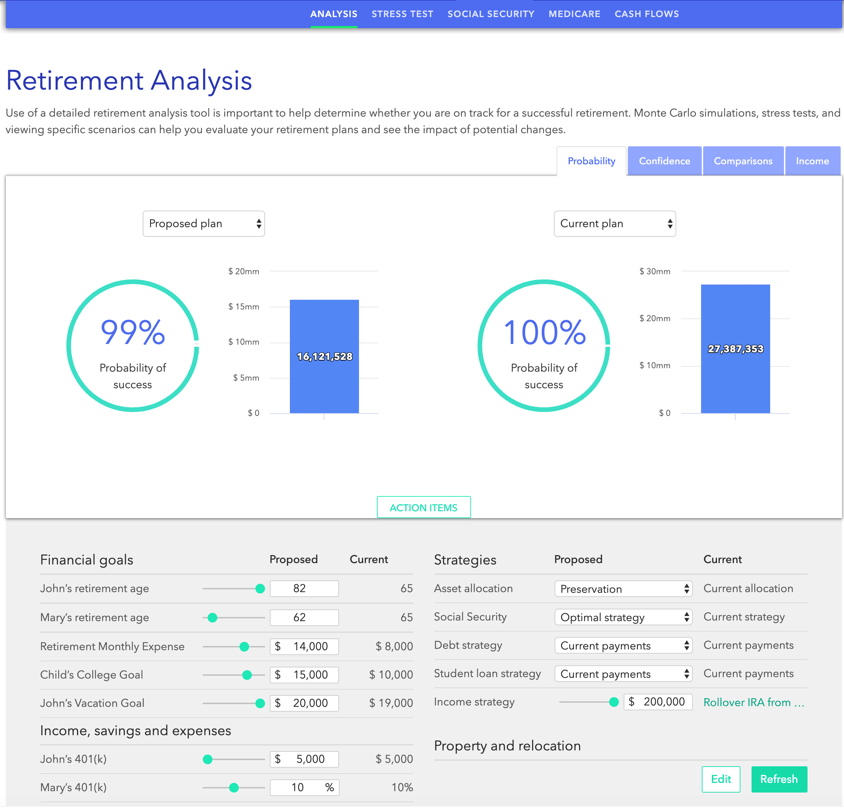

Besides the corporate value at sale, your company should help you prepare for retirement. We will help you compare multiple scenarios, illustrate stress tests on your current plan and provide certainty you need going forward.

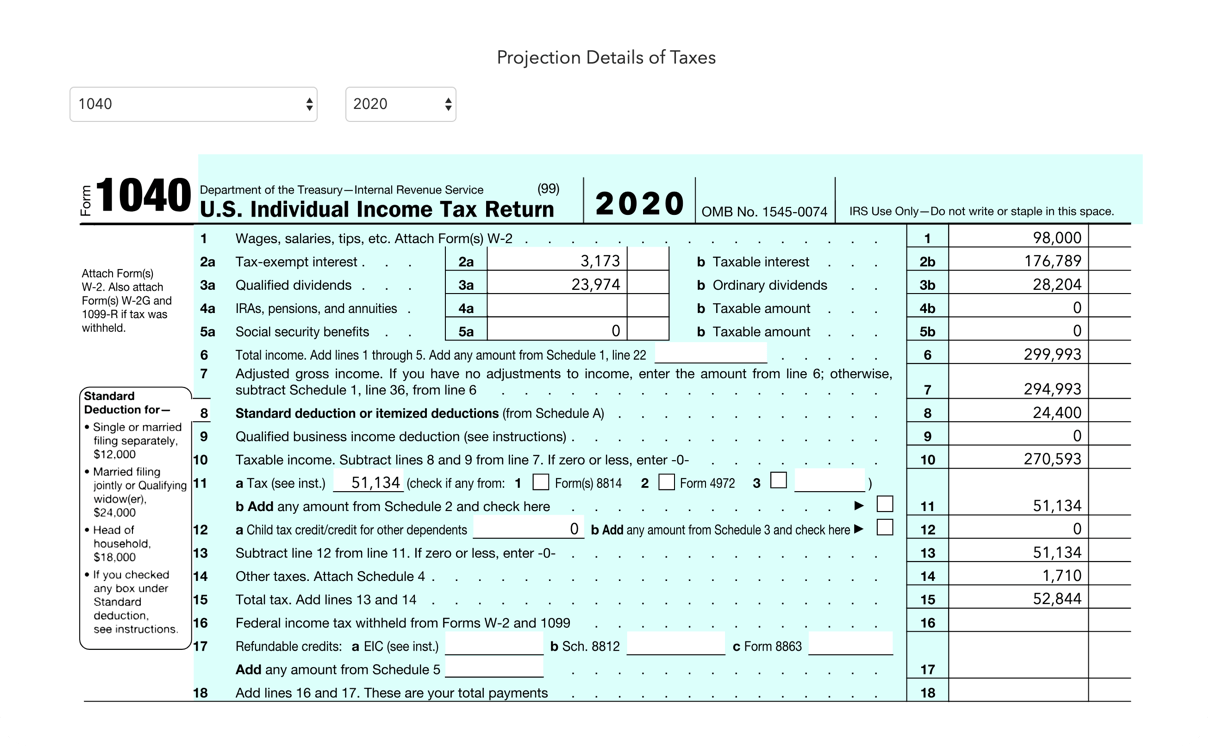

Innovative Tax Efficient Planning and Distribution Strategies to Save You Money

- Most accountants and CPA’s are pulling from a list of 50 to 75 deductions

- That’s not even a fraction of what is available to you in our 9 million word tax code

- There are more than 400 legal deductions—when properly documented

- What you must do to protect yourself is to audit-proof your tax records

- You CAN—with the right strategies

CFO Services

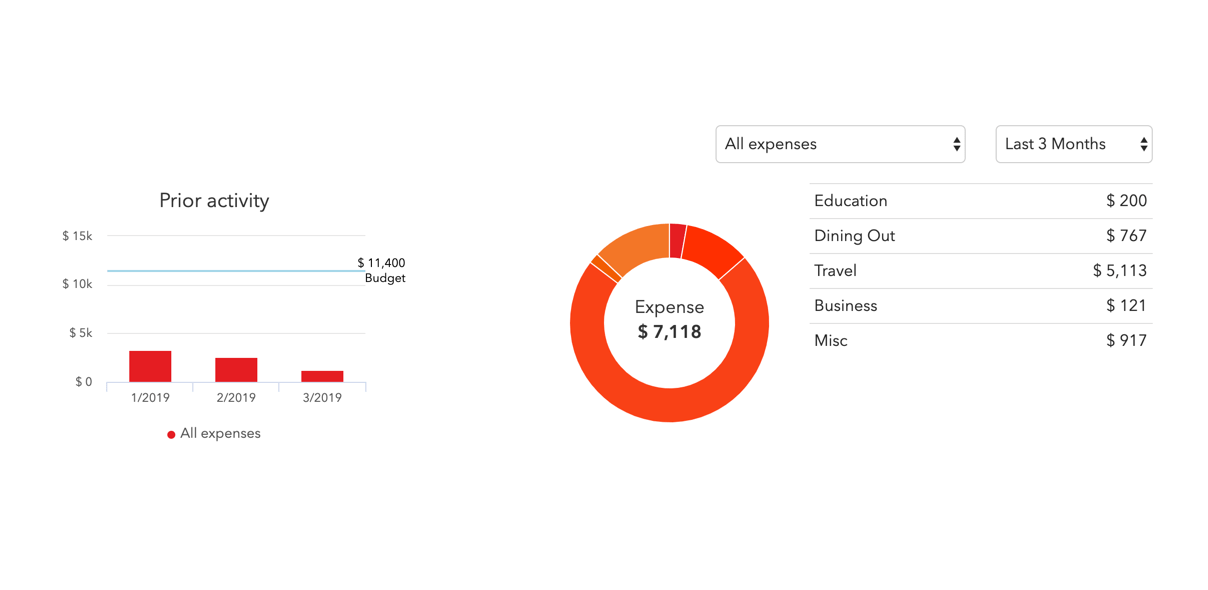

Accelerate your growth with expert CFO support–from accurate budgets to financial strategies. Accounting/financial statements are historical and don’t give you the business analysis on what to do based on your results. Get clarity with our business dashboard.

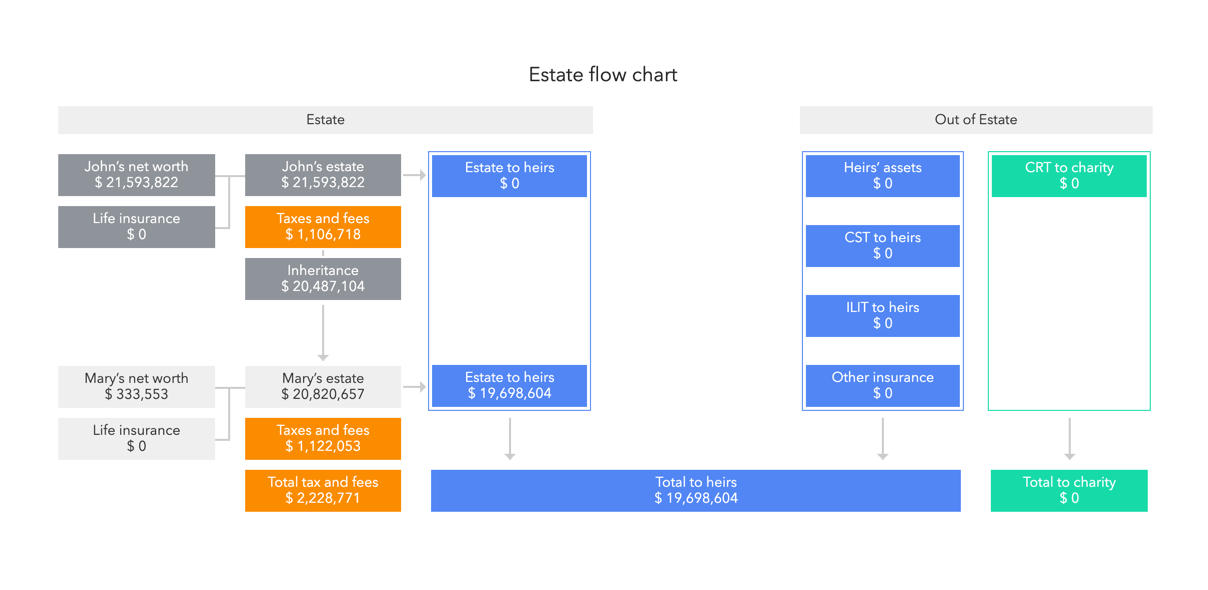

Business Succession and Estate Planning

Maximize corporate value and develop your exit plan. It starts years before you are ready to call it. Deterrmine the flow of assets including any possible estate tax ramifications. Legacy Planning. How Do You Want to be Remembered?

A Solid Tax and Business Analysis Plan

CPA Firm mission focused on helping our clients master all the financial pieces of their companies.