Principled Tax Strategies

When you work hard for your money, you need a tax plan to work hard for you

Entity Structuring

Special purpose entities that serve a legitimte business purpose but allow their owners to create a “tax arbitrage” by legally shifting income from higher taxed entities to lower.

Tax Strategy, Implementation and Preparation

The target is to minimize taxes to the legally permissible amount. No financial plan is complete without a tax plan. Let’s set a target together.

Business Advisory

Business entity structuring/restructuring, merger/acquisition, succession/exit planning. The conversation should start with the most trusted advisor, your CPA. Let’s have a conversation

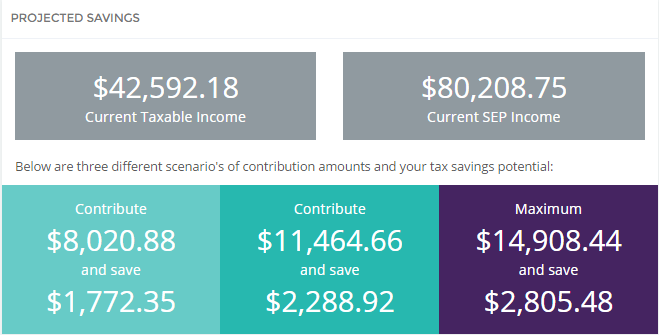

An Actual Tax Plan with All Action Steps

Through a simple, dynamic interface that changes when your numbers and situation changes, with our help and this documented tax plan, you can have absolutely certainty that your plan is perfect.

Fully Integrated Business and Personal Planning

All of your financial information is integrated and considered in your customized tax plan. The tax plan is designed dynamically to play out “What If” scenarios with the goal of legally reducing your income tax liability to the minimum amount possible.

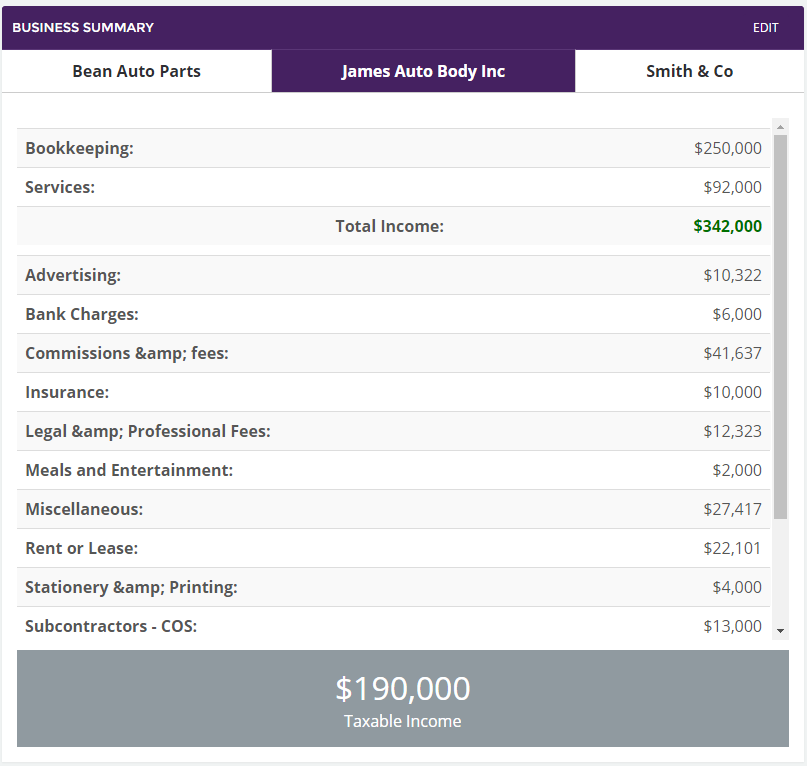

Multiple Entity Engineering Integrated Tax Planning

Our client planning many times involve the use of multiple companies. Also, you may already own a number of different business operations. And you know the tax complexity this can cause. Now it is all integrated seamlessly in your dashboard.

F.A.Q.

What is the tax philosophy of Symmetry Group Advisors?

Our one objective is to assist you in getting where and when you’re certain of where you want to go. Our firm provides process and structure to assist in the control of financial decisions and their impact on your business and life plans. We believe that the integration of wealth and tax strategies is a holistic and comprehensive approach that serves our clients and this is our calling.

What services do you provide?

Financial advice, both in your business and personally in the areas of taxes, entity engineering, investments, insurance, exit planning, estate planning, pensions, estates and trusts.

Outside of filing taxes how else can I use the services of a CPA?

Tax planning is a critical part of financial growth for individuals and businesses. Our planning team provides a plethora of useful services – from understanding what expenses qualify as deductions for your particular business, identifying the appropriate expenses that you may have missed and helping you to put your information in a format that makes the tax filing process easier, we can help you navigate the complex subject of taxes and make the process easier.

Why would I use the same firm to work with me on taxes and financial planning?

It’s important to work with a firm that not only prepares your taxes, but plans with you throughout the year. As financial advisors, we recognize that the outcomes on an income tax return are the culmination of many decisions. Tax efficiency is a vital part of a financial plan at every stage, and so we approach tax planning as both a year-round and lifelong process

Still Have Questions?

Don’t hesitate to reach out to us anytime